Dhurandhar Movie Review LIVE Updates: Ranveer Singh aur Aditya Dhar ki much-awaited action-espionage thriller Dhurandhar finally 5 December ko release ho chuki hai, aur release ke saath hi yeh movie town talk of the town ban gayi hai. Film mein Ranveer Singh ke saath Sanjay Dutt, R Madhavan, Arjun Rampal aur Akshaye Khanna jaise power-packed actors nazar aa rahe hain. Makers ne pehle hi hint de diya tha ki yeh kahani real incidents se inspired hai, lekin exact details public ke saamne nahi rakhi gayi.

Kuch time pehle yeh bhi rumour tha ki Dhurandhar, late Major Mohit Sharma ki biopic hai. Lekin director Aditya Dhar ne X (Twitter) par aakar officially in sab reports ko completely false bata diya.

Dhurandhar ek hardcore espionage thriller hai jo India ke political aur security environment par deeply based hai. Film ko CBFC ne A certificate diya hai. Final runtime hai poore 3 ghante 34 minute — jo kaafi lamba hai. Reports ke mutabik, movie ke end mein 4 minute ka ek post-credit scene bhi hai. Sabse exciting baat yeh hai ki Dhurandhar ek two-part film hai aur iska Part 2 Summer 2026 mein release hone ki ummeed hai.

Story ki baat karein toh Dhurandhar undercover agent Hamza (Ranveer Singh) ke around ghoomti hai, jo Karachi ke terror network mein ghus kar gangster Rehman (Akshaye Khanna) ka bharosa jeet-ta hai. Dheere-dheere uska face-off hota hai dangerous ISI officer Major Iqbal (Arjun Rampal) se. Film ke plot mein IC-814 hijack aur 26/11 jaise real historical incidents ke references bhi add kiye gaye hain. First half ka tension kaafi strong hai, lekin second half thoda drag karta hai. Climax bhi utna powerful nahi lagta, aur 214 minute ka runtime thoda zyada feel hota hai.

Performance ki baat karein toh Ranveer Singh ne zabardast comeback type performance di hai — intense bhi, charming bhi. Akshaye Khanna apne role mein deeply impress karte hain. Arjun Rampal ek menacing villain ke roop mein kaafi suit kiye hain. Sanjay Dutt apni swag ke saath screen pe shine karte hain. Lekin Sara Arjun ki casting audience ko zyada convince nahi kar paati.

Technical aspects kaafi strong hain — khaaskar background music jo action scenes ko aur bhi powerful bana deta hai. Lekin kuch gaane zabardasti ghusaye gaye lagte hain aur pacing slow hone ki wajah se engagement thoda kam ho jaata hai.

Major Mohit Sharma controversy par baat karein toh unke parents ne court mein objection dala tha ki film unke bete ki life se inspired hai. Iske baad Delhi High Court ke order par CBFC ne film ka dobara review kiya. 2 December ko review ke baad CBFC ne officially clear kiya ki Dhurandhar ek fictional film hai aur iska kisi bhi tarah se Major Mohit Sharma ki biopic se koi lena-dena nahi hai.

Final Verdict: Dhurandhar ek lambi, uneven thriller hai jisse stellar performances aur strong action sequences kaafi had tak sambhal lete hain. Ending thodi weak hai, lekin Ranveer Singh ka powerhouse performance is movie ko dekhne layak bana deta hai. Saath hi yeh Part 2 ke liye ek exciting setup bhi create karta hai.

Dhurandhar Movie Rating, Reviews aur Box Office Collection ke latest LIVE updates ke liye bane rahiye humaare saath!

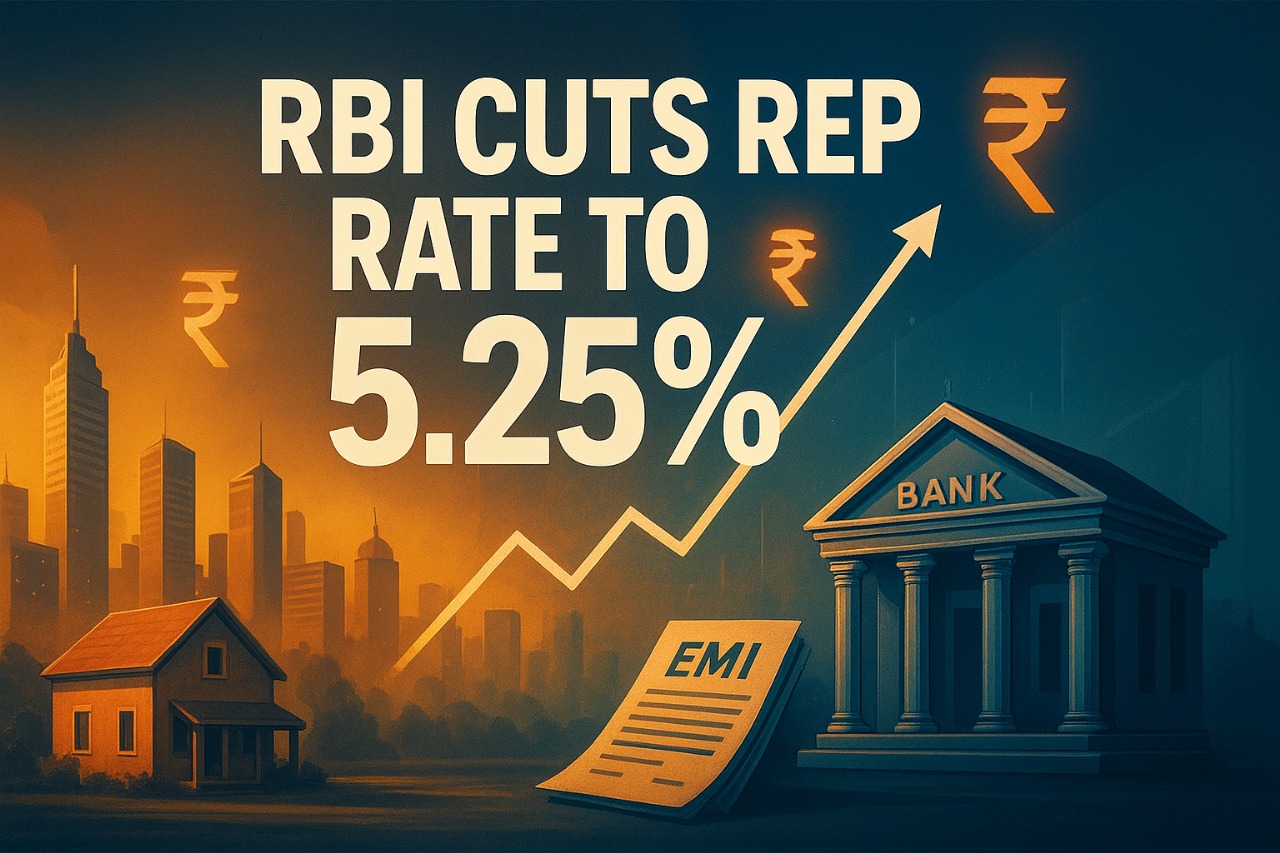

RBI ne Repo Rate 25 BPS Kam Karke 5.25% Kar Diya – Home Loan Aur Market Ko Milega Bada Boost!

RBI ne Repo Rate 25 BPS Kam Karke 5.25% Kar Diya – Home Loan Aur Market Ko Milega Bada Boost!