Rich Dad Poor Dad Author’s Warning Biggest Crash in History says ‘best option is to…’

Rich Dad Poor Dad ke author Robert Kiyosaki ne ek baar phir se market mein tezz charcha chhed di hai. Unhone X (Twitter) par post karte hue bola ki “the biggest crash in history” ab shuru ho chuka hai.

Kiyosaki ke according, duniya ki economy par pressure rapid technology change, AI ke rise aur global instability ki wajah se barhta ja raha hai.

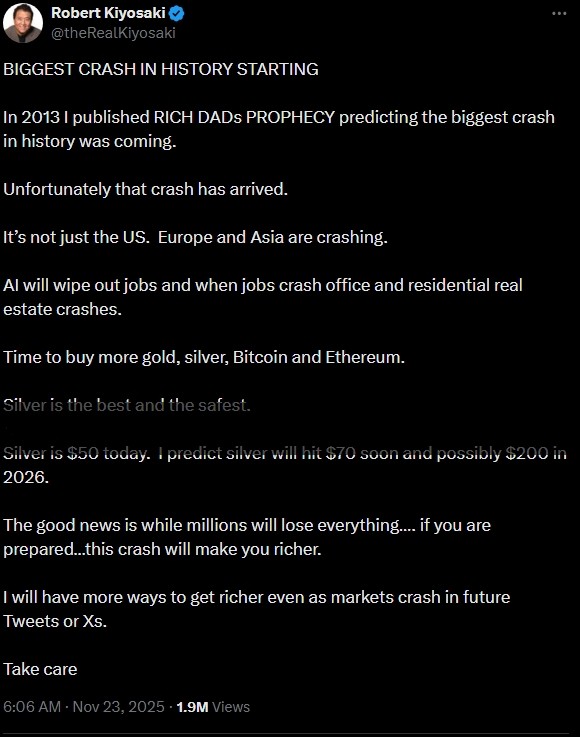

Unhone likha:

“2013 mein maine RICH DAD’s PROPHECY publish ki thi jisme maine history ka sabse bada crash aane ka prediction diya tha. Woh crash ab a chuka hai. Sirf US nahi, Europe aur Asia bhi crash ho rahe hain. AI jobs ko wipe out karega, aur jab jobs crash hongi to office aur residential real estate bhi crash hoga.”

AI ke wajah se job losses, real estate par badh raha stress aur global uncertainty – in sab ko dekhte hue Kiyosaki ka kehna hai ki financial duniya bahut tezi se badal rahi hai. Jo log time par prepare nahi honge, unhe bade losses ka samna karna padega.

Kiyosaki ka Investors ke Liye Advice

Unke latest post ke hisaab se sabse best option silver hai, aur volatility ke time par gold ko bhi consider karna chahiye.

Unka exact message:

“Time to buy more gold, silver, Bitcoin and Ethereum. Silver is the best and the safest. Silver is $50 today. I predict silver will hit $70 soon and possibly $200 in 2026. Jo prepared hoga woh is crash se aur ameer banega.”

Kiyosaki kehta hain ki jab millions log sab kuch lose karenge, wahi log paise kamaayenge jo aaj se hi ready ho gaye.

Robert Kiyosaki on Precious Metals – Gold & Silver

Kiyosaki hamesha se gold aur silver ke supporter rahe hain, especially crisis ke time mein.

Unhone 2021 ki ek interview mein kaha tha:

“I’m not buying gold because I like gold, I’m buying gold because I don’t trust the Fed.”

Iss baar unka special focus silver par hai.

Unke words:

“Silver is the best and safest… I predict silver will hit $200 by 2026.”

Gold ke baare mein bhi unhone bold prediction diya:

“My target price for Gold is $27k,”

ye prediction unke dost aur investment guru Jim Rickards par based hai.

Kiyosaki ne ye bhi reveal kiya ki woh personally is trend ke liye prepared hain:

“I own two goldmines.”

Kiyosaki’s Crash Prediction – Purani Future Warning Ka Continuation?

Unka new post unhi ke 2002 ke book Rich Dad’s Prophecy se jodta hai.

Unhone tab hi predict kiya tha ki 2020s ke around ek major market crash aayega.

Ab woh bol rahe hain ki AI ke wajah se US, Europe aur Asia mein job losses badh rahe hain, jis se wahi major crash start ho chuka hai jiska unhone decades pehle prediction kiya tha.

Silver unke hisaab se aaj bhi safest option hai.

Criticism & Online Reaction

Haan, Kiyosaki ke predictions past mein kai baar galat bhi sabit hue hain, especially 2025 ke kuch crash predictions jo reality mein nahi hue.

Isliye unke latest warning par bhi social media par mixed reaction aaya.

Grant Cardone jaise business personalities ne openly unki baat ko reject kiya.

Phir bhi, unka post ek bada debate start karta hai:

-

Kya AI economy ko disturb karega?

-

Kya yeh current volatility temporary hai?

-

Ya phir ek massive economic shift shuru ho chuka hai?